Imagine this: you’re sailing in the famous East Blue (from One Piece), with a gentle gust of wind steering your caravel towards the desired destination.

Suddenly, the wind starts to batter your ship. You see a massive storm brewing on the horizon, accompanied by thunder and lightning. What’s your next move? Do you align the main sail along the wind’s flow, or do you furl the sails and start paddling?

Your comp plans are quite similar to this caravel ⛵

You see, a lot can change within the blink of an eye: a pandemic might disrupt daily routines, a brand-new industry could surface, or your sales strategies could change. All these signals guide you to one essential task: revamping your comp plans.

If your comp plans don’t incentivize the right behaviors, reps don’t get compensated for the right accomplishments. This sets off a chain reaction of unwanted consequences: lower motivation levels, a spike in attrition rate, and a steep decline in employee morale.

And unless you fix these holes in your ship, you’re going to inevitably sink. So, it’s ideal for you to revisit your comp plans at least once a year to ensure their relevance and effectiveness.

Here are 5 key metrics that you need to consider while reassessing your comp plans. Let’s dive in to know more!

Performance Measures

Performance measures are paramount to comp plan re-evaluation because they translate sales strategy into quantifiable tactics. They usually fall under one of three categories:

- Volume measures: sales revenue, gross margin, unit sales, etc.

- Sales effectiveness measures: product mix, cross-selling, conversion rate, etc.

- Resource utilization measures: quota attainment, cost per order, etc.

Since each business is unique, it’s essential to tailor performance measures for each role based on the business’s needs. This will ensure that your comp plans are helping you drive business growth in the right way.

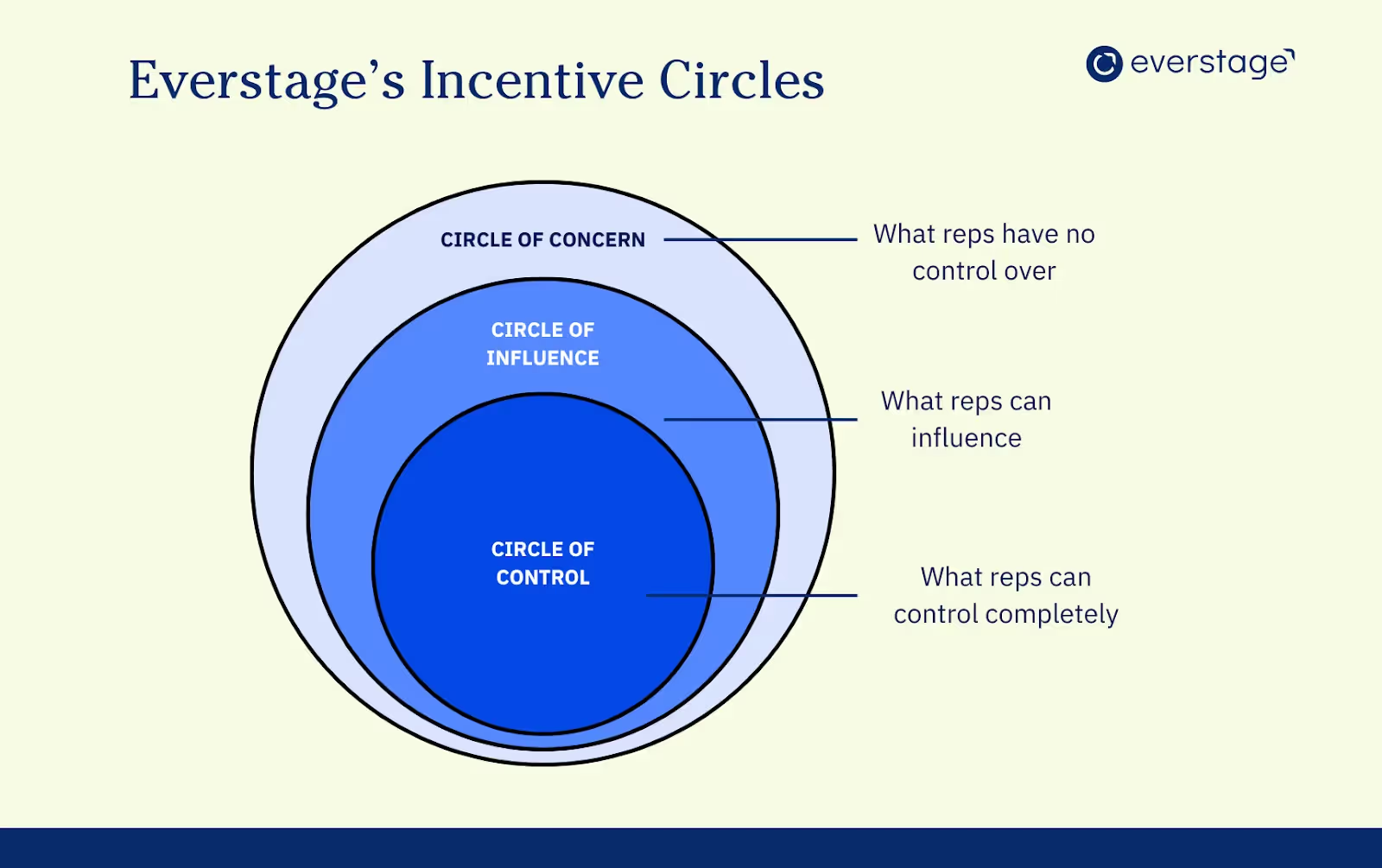

To help you determine the right performance measures, we at Everstage devised a unique method called “Incentive Circles”, based on 2 key theories:

- Stephen Covey’s 3 Circles, i.e., circle of control, circle of influence, and circle of concern.

- David Cichelli’s criteria for performance measures: Choose only 3 or fewer measures. Adding more would distort your comp plan’s true purpose.

Let’s consider the example of a software sales rep. Here’s how we can apply Everstage’s Incentive Circles model to it:

- Circle of control: This is something that the rep can easily control, like the deal size.

- Circle of influence: This is something that the rep can influence, like the length of the deal cycle.

- Circle of concern: These are things that reps have no control over, like onboardings and renewals.

To re-evaluate your performance measures, follow these two guidelines:

- Choose 3 or fewer performance measures.

- Ensure that the weightage for each performance measure does not go below 15%.

Read more about the Everstage’s Incentive Circles here.

Pay Mix

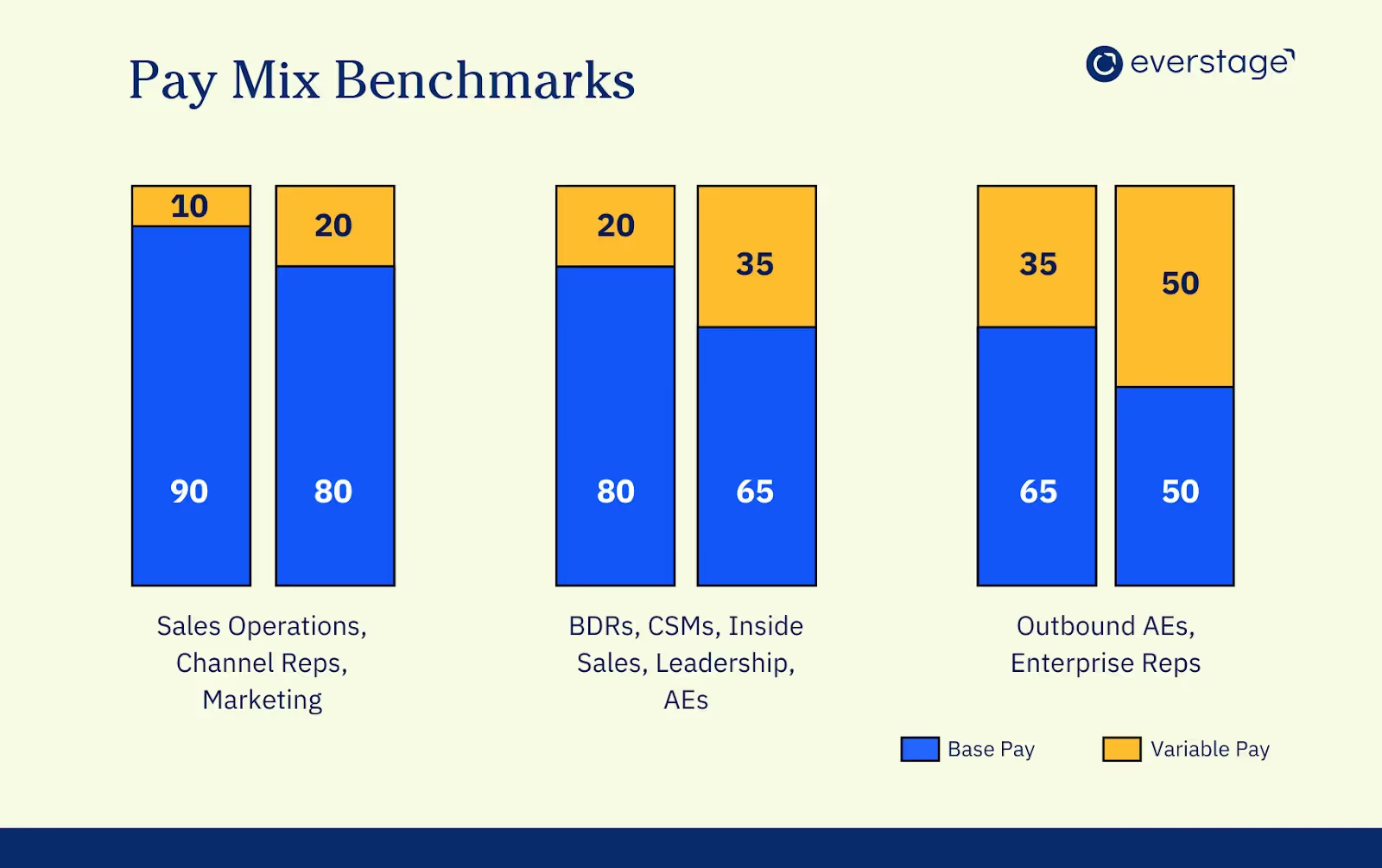

It’s the ratio of your base pay (the fixed component) to your target incentive (the variable component), commonly represented as X/Y. Together, they form the target total cash compensation (TTCC), otherwise known as on-target earnings (OTE).

A recurring issue tied to setting pay mix is when the hiring process happens without an Ops or a Finance person being involved. In a rush, you might hire one rep at a 70/30 mix and another at a 50/50 mix. This pay imbalance could cause disputes and demotivation.

The ideal way to resolve this is by understanding how pay mixes should be determined. Pay mix should reflect the influence a particular role has on the purchase decision.

For instance, if the role has a significant influence, choose an aggressive mix, i.e., one with a minimal difference between the base and incentive pay. Here are a few benchmarks to consider:

Reassessing pay mixes guarantees that your roles are fairly compensated based on the influence they have over purchasing decisions.

Quotas

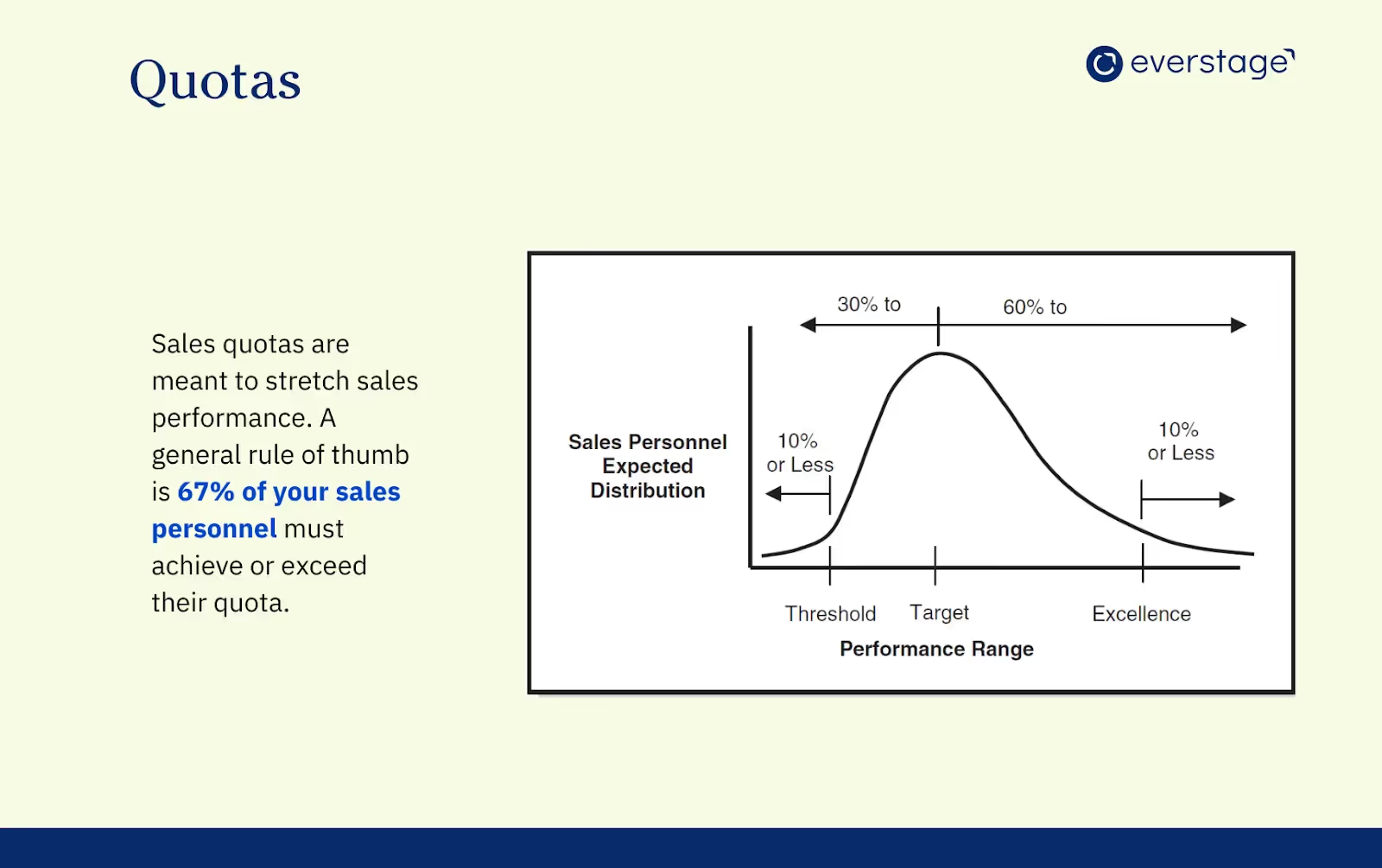

Quotas determine your comp plan’s success. While it might be a daunting task to achieve them, it’s important to understand that they are meant to push sales performance. Comp plans are not designed to appease sales teams.

Quota setting relies on two important factors: revenue goals and sales role definition. The problem around setting quotas arises when they’re created using a one-size-fits-all approach, without adequate inputs from sales or finance teams.

This could become problematic in a scenario where you’re expanding to a new market and set your quotas too low — and you end up overpaying your reps.

Quota planning must then be closely aligned with your business goals. Involve both finance and sales teams, and gather early feedback from your reps to establish realistic targets. Tailor your quotas for each rep and region.

Ideally, you need to set quotas such that at least 67% of your reps achieve or exceed them. This approach also creates a dynamic where the cost of compensation gets distributed based on the reps’ performance.

Consult your industry’s market data and your company’s revenue goals before setting quotas.

Read more on how to set realistic sales quotas here.

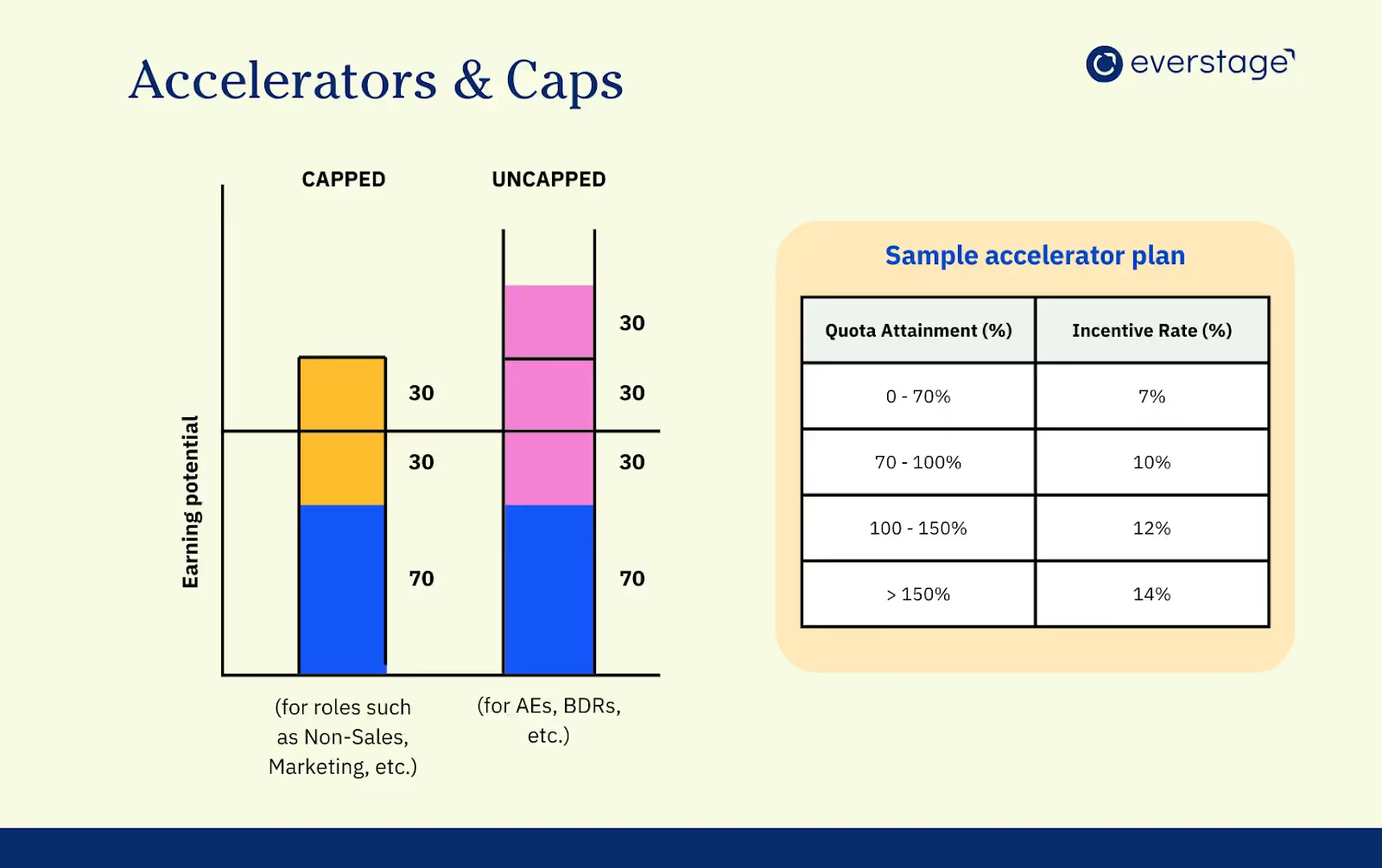

Accelerators and Caps

Accelerators are created solely to reward your outperformers when they go beyond 100% attainment. The reason behind adding accelerators to your comp plans is to avoid practices like sandbagging, i.e., when reps push one deal from the current quarter to the next. You need to incentivize your reps to bring revenue forward.

However, they can backfire if there’s no logic behind creating them. Most companies end up overcompensating their reps due to the lack of customized accelerators and caps.

Here are a few considerations to keep in mind while setting up accelerators:

- Accelerators should apply to the measures in the Circle of Control (refer to Everstage’s Incentive Circles). For instance, if a BDR has 2 performance measures — no. of opportunities and dollar amount contribution to pipeline, the accelerator must be applied only to the primary measure.

- Accelerators usually kick in when a rep attains 100% quota. However, in difficult market conditions, they can apply at a 90% quota for high performers.

- A general guideline is to set a 2x incentive with a 150% capped payout for non-sales roles like operations, demand generation, partnerships, etc.

Thresholds and Ramps

Thresholds

Thresholds indicate the minimum quota that a rep must achieve for the incentives to apply. Each rep has a personalized threshold value, ensuring that they stay driven to hit this target.

Without them, incentives might be rewarded irrespective of quota attainment, which can demotivate high-performing reps. Thresholds also help reps to monitor their progress against their previous performance.

Ramps

Ramps are created for new sales reps to understand the product and start their selling journey. Issues might arise when they’re not given enough ramp-up time, leading to disappointment and turnover.

The general rule of thumb for an ideal ramp-up is the length of your sales cycle plus 90 days for your reps to complete training and deliver a few demos.

Summary

You need to revisit your comp plans annually and verify their relevance and effectiveness with respect to your business goals and market conditions. Here’s a quick snapshot of the 5 key metrics to consider while reviewing your comp plans:

We’ve also worked with David Miller, CSCP (Senior Manager, Sales Compensation at Integrated Data Technologies) on a detailed 5-step framework to revamp your comp plans.

You can download your copy here.

We hope you breeze through your comp plan re-evaluation process and set sail to the seas of success. Good luck!

.avif)

.avif)

.avif)

.avif)